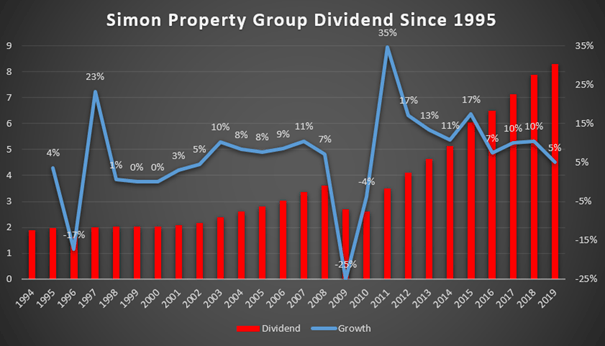

The company has grown its dividend for the last 1 consecutive years and is increasing its dividend by an average of -568 each year. 69 sor Simon Property Group cut their dividend during the global recession in 2009 which hit.

Simon Property Group Shares Are Worth Over 100 I Ll Show Why Nyse Spg Seeking Alpha

Simon Property Group Shares Are Worth Over 100 I Ll Show Why Nyse Spg Seeking Alpha

3242020 Simon cut the dividend in the second quarter of 2009 to 060 and provided a payment that consisted of 80 stock and 20 cash.

Did simon property group cut their dividend. I was expecting them to announce their dividend announcement as part of that release given the fact that they are about 2 weeks late to their usual dividend declaration. This continued until the first quarter of 2010 when the company. This made it a Dividend Contender before the cut.

SPGs next quarterly dividend payment will be made to shareholders of record on Friday April 23. 5122020 Simon Property Shares Surge After Biggest US. Yield Falls to 76 The REITs distribution is chopped by nearly 40.

I read the latest press release for Simon Property Group SPG. It is a popular stock for those seeking income and dividend growth. Although most are re-opening a new wave of COVID-19 can force it to close them again.

762020 Simon Property Group SPG is another real estate invest trust or REIT that has cut its dividend. 972020 Simon Property Group SPG cut its dividend by 381 percent Raytheon Technologies RTX cut its dividend by 354 percent Welltower WELL cut its dividend by 299 percent A third group of companies hit by COVID-19 are the ones that did not announce their annual dividend increase yet including many Dividend Aristocrats such as Lowes Companies. They did mention the word dividend in their latest press.

The REIT was dividend growth stock having raised the dividend for 10 consecutive years. 712020 Simon Property Cut Its Dividend By 38 Simon Property Group NYSESPG cut its quarterly dividend from 210 to 130 per share. NEW YORK May 1 Reuters - Simon Property Group Inc SPGN posted better-than-expected results on lower expenses but the largest US.

Heres what the CEO had to. Mall operator plans to have at least half of its 200 retail properties up-and-running by. A stocks dividend reliability is determined by a healthy payout ratio that is higher than other stocks.

Simon hasnt but its going to. I read the latest press release for Simon Property Group SPG. 112 sor 1042006 Click Here for Dividend History for Series F Preferred Stock.

Fears of dividend stability were moderately quenched late last month when Simon Property declared its dividend with a 38 cut from its February payout. Many of its retail properties were temporarily closed due to the COVID-19 pandemic. Mall owner cut its cash and stock dividend sending its.

692020 The malls that Simon Property Group NYSE. High dividend yields usually over 10 should be considered extremely risky while low dividend yields 1 or less are simply not very beneficial to long-term investors. This could indicate that the company has never provided a dividend or that a dividend is pending.

SPG owns are starting to reopen again after being shut down by the government in an attempt to contain the spread of COVID-19. 5122020 Simon Property Groups SPG is Ambiguous on Dividends. 692020 Simon Property Group Telegraphs a 50 Dividend Cut Mall REITs have taken a hit from COVID-19 with most having now cut their dividends.

5152020 Simon Property Groups SPG is Ambiguous on Dividends. Dividend history information is presently unavailable for this company. With tight cash flowing through its.

Mall Owner Vows Q2 Dividend Simon Property the biggest US. 5122020 However in light of the coronavirus pandemic and related setbacks Simon Property has withdrawn its guidance for the full year issued on Feb 4. They did mention the word dividend in their latest press.

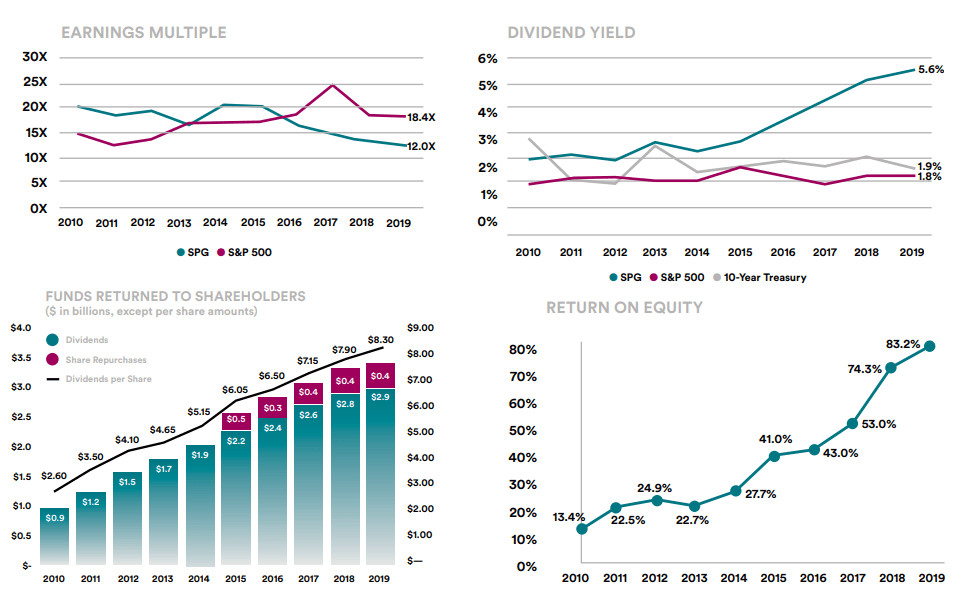

712020 Simon Property Group Cuts Its Dividend. Simon Property Group pays an annual dividend of 520 per share with a dividend yield of 454. Thats very good news but the hit this real estate investment trust REIT is suffering through isnt over yet and thats on top of a big pre-existing headwind.

I was expecting them to announce their dividend announcement as part of that release given the fact that they are about 2 weeks late to their usual dividend declaration.

Simon Property Group As The Dividend Approaches 20 Don T Miss Out Nyse Spg Seeking Alpha

Simon Property Group As The Dividend Approaches 20 Don T Miss Out Nyse Spg Seeking Alpha

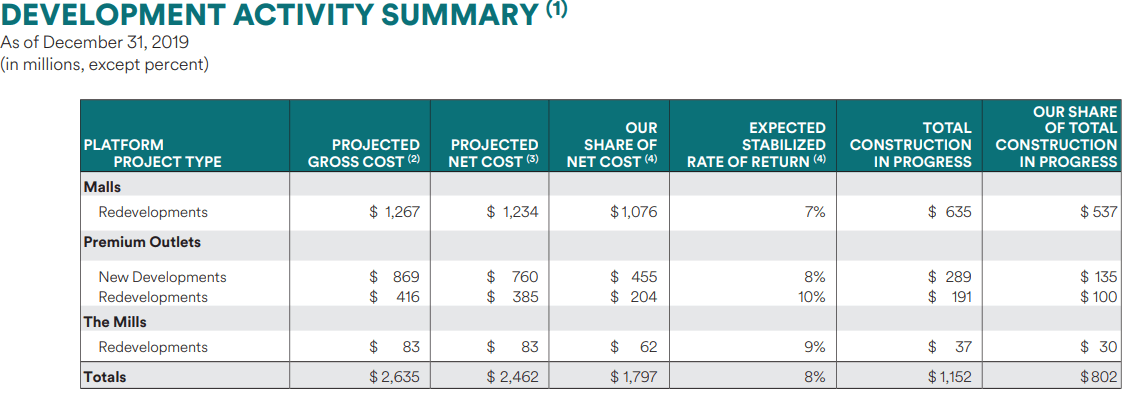

How To Invest In Reits Pros Cons And Simon Property Group Example Analysis Sven Carlin

How To Invest In Reits Pros Cons And Simon Property Group Example Analysis Sven Carlin

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

Spg Dividend Yield History Payout Ratio Simon Property Group

Spg Dividend Yield History Payout Ratio Simon Property Group

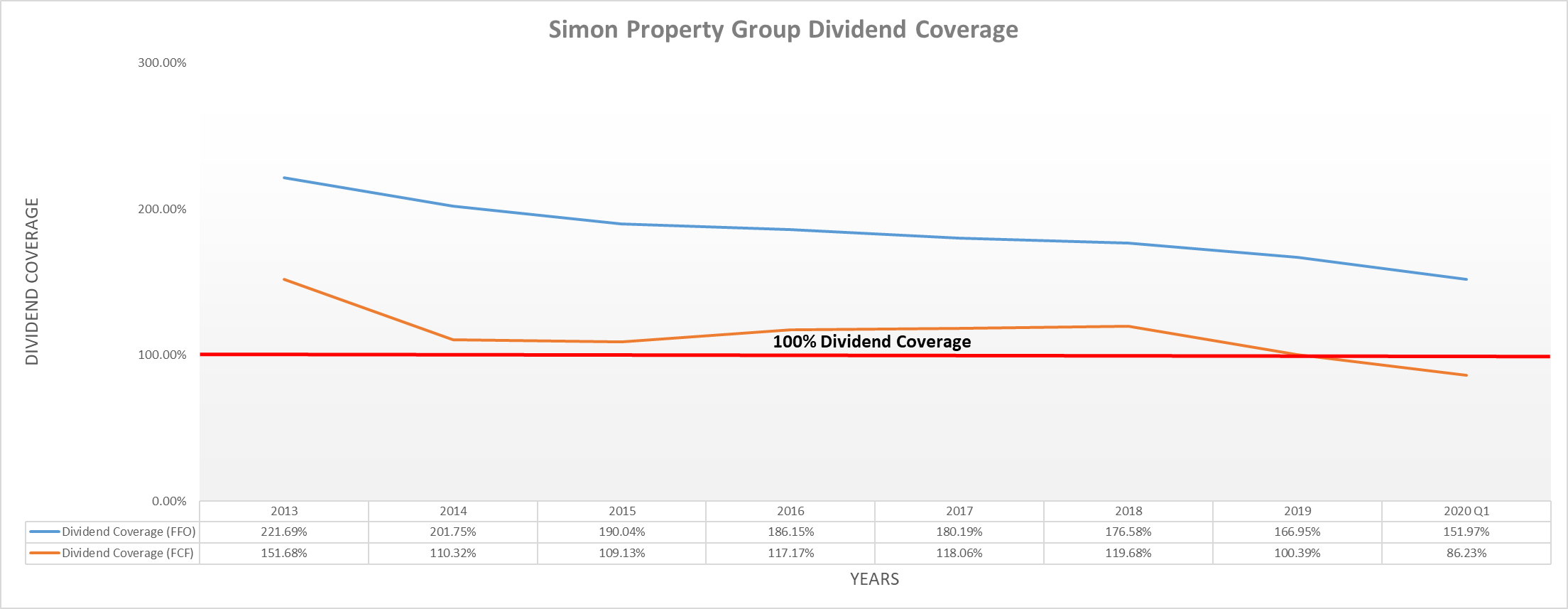

Can Investors Count On Simon Property Group Inc S 7 6 Yield

Can Investors Count On Simon Property Group Inc S 7 6 Yield

Simon Property Group As The Dividend Approaches 20 Don T Miss Out Nyse Spg Seeking Alpha

Simon Property Group As The Dividend Approaches 20 Don T Miss Out Nyse Spg Seeking Alpha

Simon Property Group Inc Spg Dividends

Simon Property Group Inc Spg Dividends

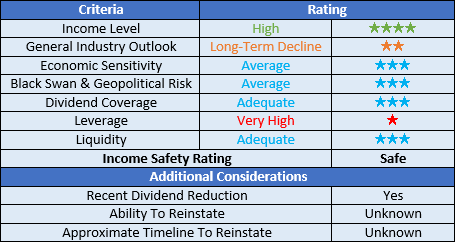

Simon Property Group 7 4 Yield Discounted Price Real Risks Nyse Spg Seeking Alpha

Simon Property Group 7 4 Yield Discounted Price Real Risks Nyse Spg Seeking Alpha

Simon Property Group A High Yield Reit Adapting To The Times Intelligent Income By Simply Safe Dividends

Simon Property Group A Worst Case Scenario Priced In Nyse Spg Seeking Alpha

Simon Property Group A Worst Case Scenario Priced In Nyse Spg Seeking Alpha

Simon Property Group Spg A High Yield And High Risk Reit Dividend Growth Investor

Simon Property Group Spg A High Yield And High Risk Reit Dividend Growth Investor

Dividend Growth Investors Focus On Their Dividend Income Writing Covered Calls Against Your Positions Is Another Way To Dividend Income Dividend Covered Calls

Dividend Growth Investors Focus On Their Dividend Income Writing Covered Calls Against Your Positions Is Another Way To Dividend Income Dividend Covered Calls

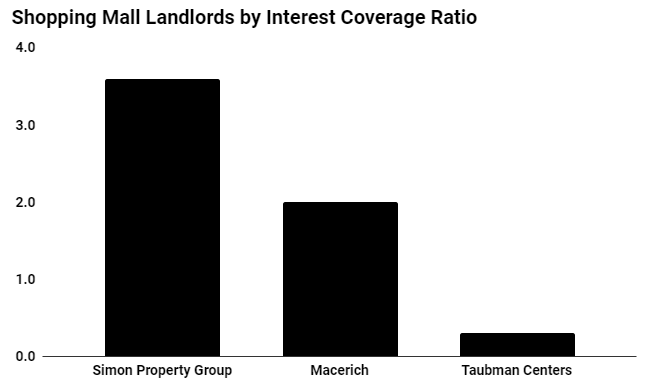

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha