112 rows 1042006 Click Here for Information on Taxability of Dividends. By month or year chart.

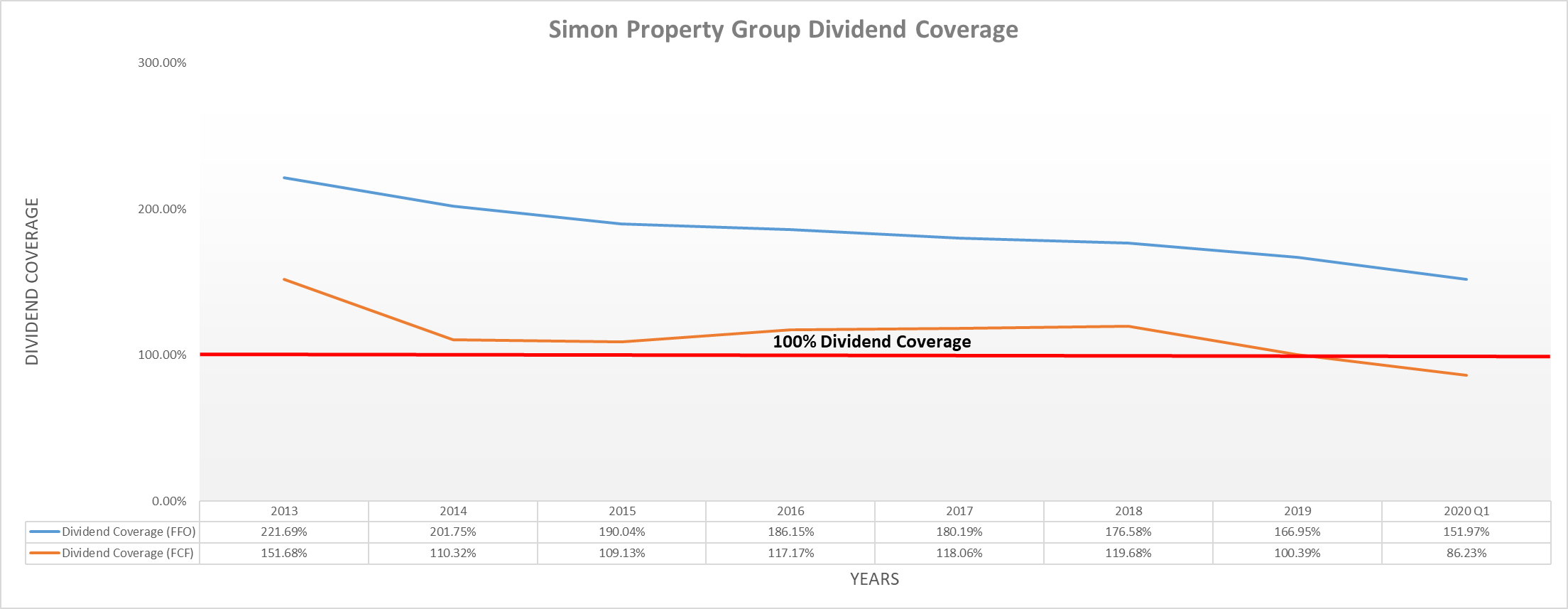

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

This could indicate that the company has never provided a dividend or that a dividend is pending.

Did simon property group cut dividend. Although most are re-opening a new wave of COVID-19 can force it to close them again. 2122021 In fact on Simon Property Groups fourth-quarter 2020 earnings conference call CEO Simon was even talking about future dividend hikes which he hinted could follow along with improved performance. But they leave open the possibility that there will be a dividend cut.

Raytheon Technologies RTX cut its dividend by 354 percent. Welltower WELL cut its dividend by 299 percent. A third group of companies hit by COVID-19 are the ones that did not announce their annual dividend increase yet including many Dividend Aristocrats such as Lowes Companies.

Simon hasnt but. The way this was worded implies a dividend cut in my opinion. Simon Property Group Inc.

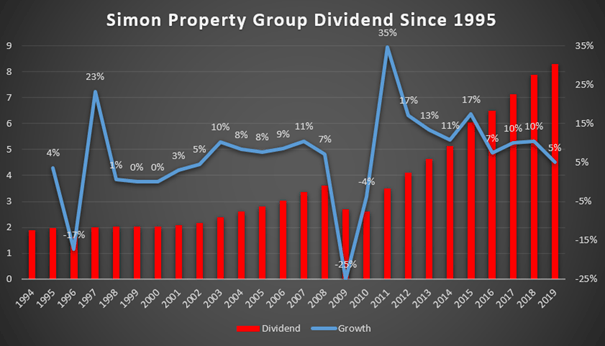

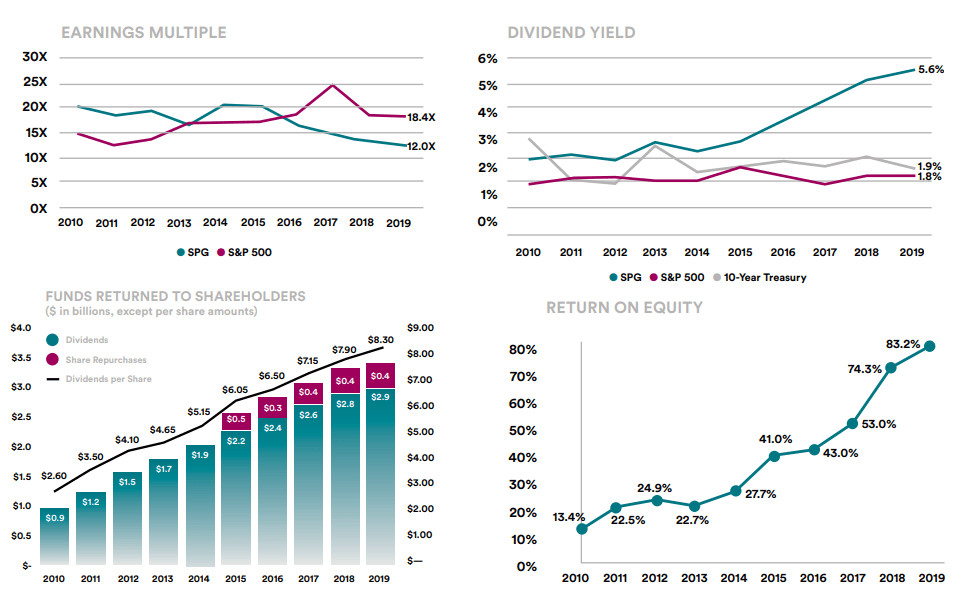

This continued until the first quarter of 2010 when the company. A stocks dividend reliability is determined by a healthy payout ratio that is higher than other stocks. The REIT was dividend growth stock having raised the dividend for 10 consecutive years.

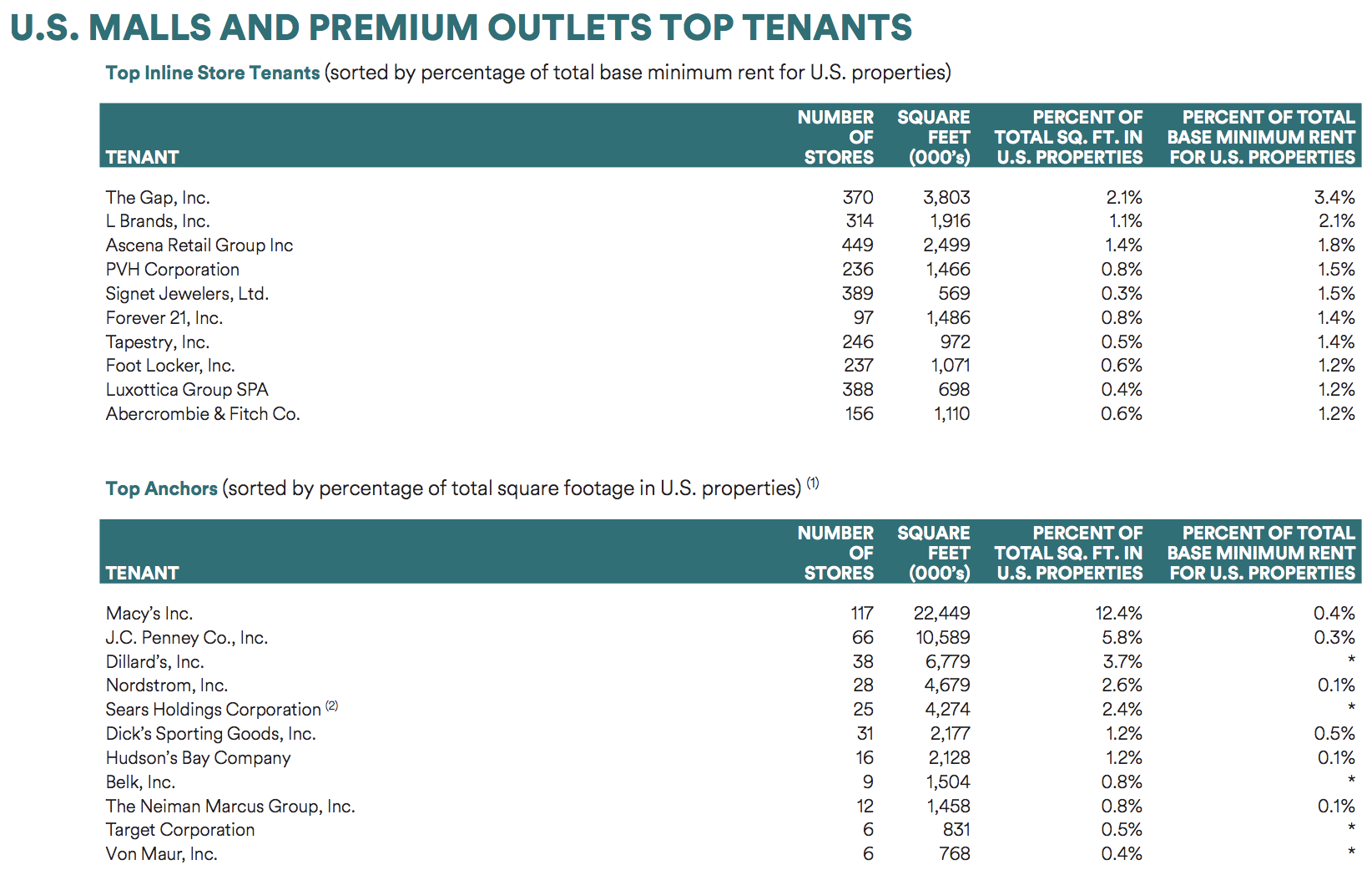

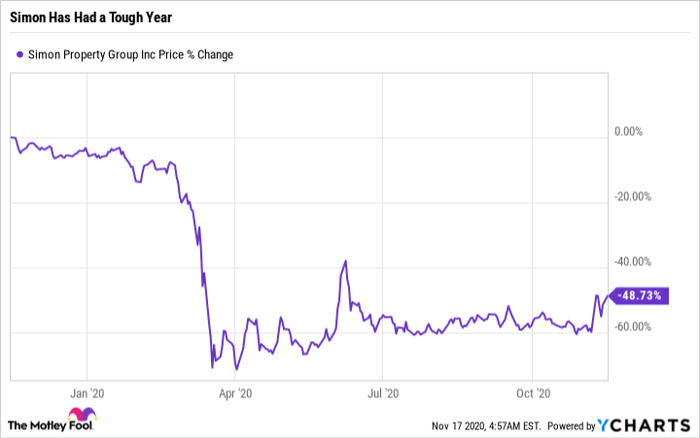

Declare date ex-div record pay frequency amount. 762020 Simon Property Group SPG is another real estate invest trust or REIT that has cut its dividend. Mall REITs have taken a hit from COVID-19 with most having now cut their dividends.

Dividends are getting cut It shouldnt be surprising with that backdrop that mall REITs are having a. High dividend yields usually over 10 should be considered extremely risky while low dividend yields 1 or less are simply not very beneficial to long-term investors. However on Monday the largest US.

712020 Simon Property Cut Its Dividend By 38 Simon Property Group NYSESPG cut its quarterly dividend from 210 to 130 per share. Mall REIT bowed to the inevitable announcing a 38 temporary reduction to its dividend. SPG dividend growth history.

Back to SPG Overview The Dividend History page provides a single page to review all of the. 5122020 On one hand they are announcing that they will pay a dividend in order to maintain REIT status. Analysts are expecting continued improvements in dividend payments despite a low dividend cover.

Yield Falls to 76 The REITs distribution is chopped by nearly 40. Many of its retail properties were temporarily closed due to the COVID-19 pandemic. Simon Property Group pays an annual dividend of 520 per share with a dividend yield of 454.

692020 In fact Simon is even suing one of its largest tenants over unpaid rent bills. Simon Property Group cut their dividend during the global recession in 2009 which hit the US property market hard. 972020 Simon Property Group SPG cut its dividend by 381 percent.

Some investors have misread this statement to say that they will keep the dividend unchanged. 3242020 Simon cut the dividend in the second quarter of 2009 to 060 and provided a payment that consisted of 80 stock and 20 cash. It is a popular stock for those seeking income and dividend growth.

722020 Dividend investors never like to hear that one of their stocks is reducing its dividend payout but Simon Property Group essentially had no choice. The company has grown its dividend for the last 1 consecutive years and is increasing its dividend by an average of -568 each year. 692020 Simon Property Group Telegraphs a 50 Dividend Cut.

Since then they have recovered well and the dividend payments have improved to over pre-recession levels. 712020 Simon Property Group Cuts Its Dividend. SPGs next quarterly dividend payment will be made to shareholders of record on Friday April 23.

This made it a Dividend Contender before the cut. 6302020 Simon Property Group was one of the last holdouts. NEW YORK May 1 Reuters - Simon Property Group Inc SPGN posted better-than-expected results on lower expenses but the largest US.

The brick and mortar retail industry were struggling mightily before the global pandemic hit and now companies that own malls are being forced to take drastic measures in order to preserve capital.

Simon Property Group Spg A High Yield And High Risk Reit Dividend Growth Investor

Simon Property Group Spg A High Yield And High Risk Reit Dividend Growth Investor

Is Simon Property Group A Buy Nasdaq

Is Simon Property Group A Buy Nasdaq

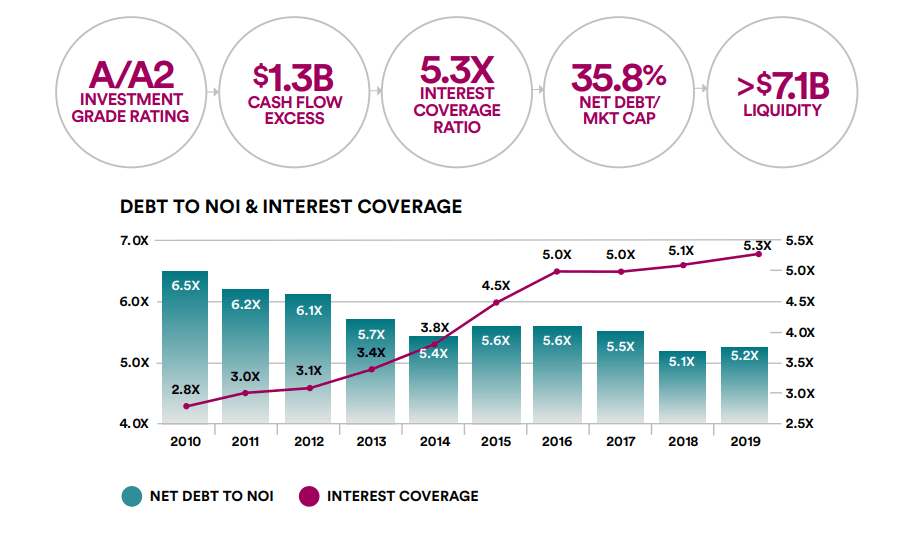

How To Invest In Reits Pros Cons And Simon Property Group Example Analysis Sven Carlin

How To Invest In Reits Pros Cons And Simon Property Group Example Analysis Sven Carlin

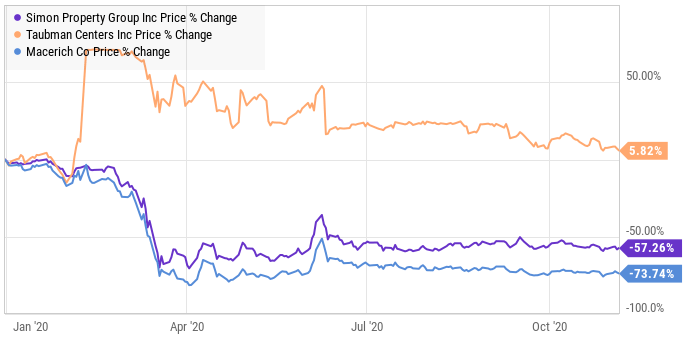

Mall Owners Simon Taubman Revise Merger Terms 800 Million Price Cut

Mall Owners Simon Taubman Revise Merger Terms 800 Million Price Cut

This Is Why Some Reits Cut Dividends And Others Don T The Motley Fool

This Is Why Some Reits Cut Dividends And Others Don T The Motley Fool

Is Macerich The Dividend Stock For You The Motley Fool

Is Macerich The Dividend Stock For You The Motley Fool

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

Simon Property Group Shares Are Worth Over 100 I Ll Show Why Nyse Spg Seeking Alpha

Simon Property Group Shares Are Worth Over 100 I Ll Show Why Nyse Spg Seeking Alpha

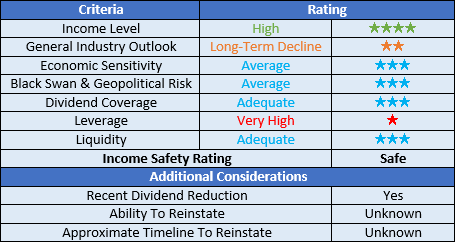

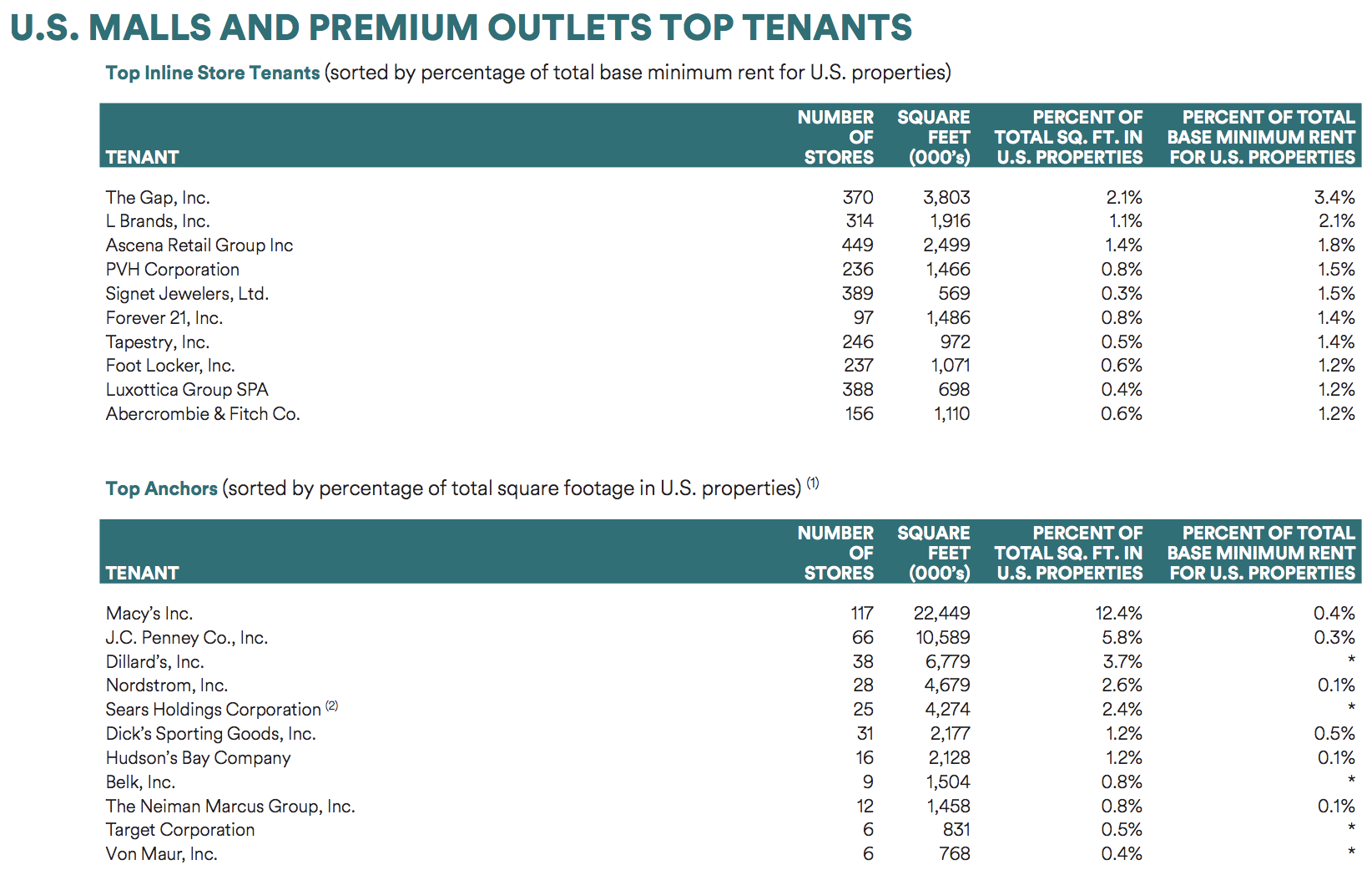

Simon Property Group A High Yield Reit Adapting To The Times Intelligent Income By Simply Safe Dividends

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

Simon Property Group A Worst Case Scenario Priced In Nyse Spg Seeking Alpha

Simon Property Group A Worst Case Scenario Priced In Nyse Spg Seeking Alpha

Simon Property Group As The Dividend Approaches 20 Don T Miss Out Nyse Spg Seeking Alpha

Simon Property Group As The Dividend Approaches 20 Don T Miss Out Nyse Spg Seeking Alpha

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Simon Property Group As The Dividend Approaches 20 Don T Miss Out Nyse Spg Seeking Alpha

Simon Property Group As The Dividend Approaches 20 Don T Miss Out Nyse Spg Seeking Alpha

8 2 Yielding Simon Property Group Priced For A Disaster That Won T Happen Nyse Spg Seeking Alpha

8 2 Yielding Simon Property Group Priced For A Disaster That Won T Happen Nyse Spg Seeking Alpha

Simon Property Group A High Yield Reit Adapting To The Times Intelligent Income By Simply Safe Dividends

Simon Property Group A High Yield Reit Adapting To The Times Intelligent Income By Simply Safe Dividends