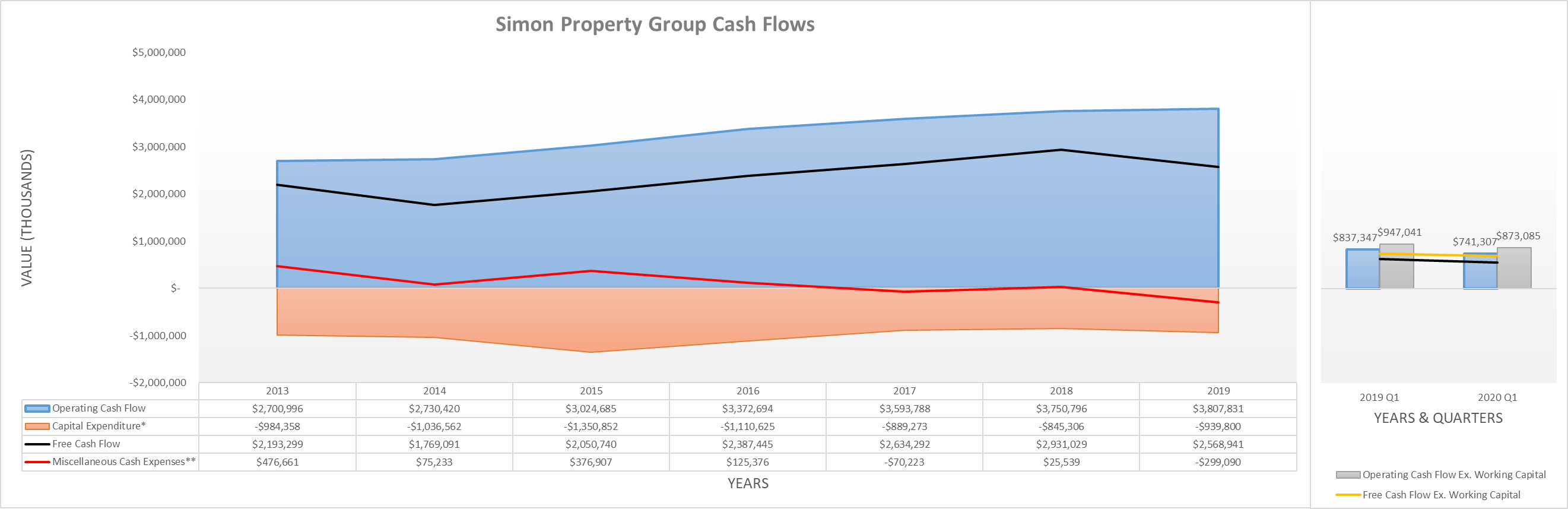

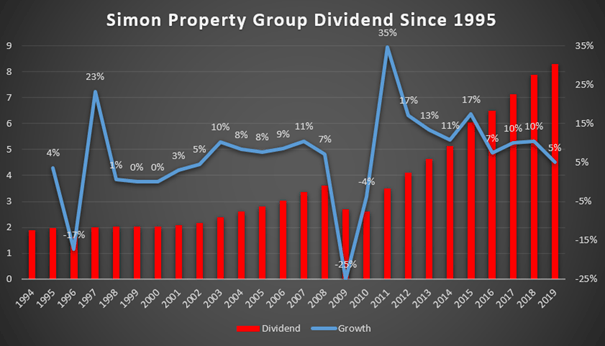

Predictably it looks as if Simon Property SPG is leaving the mall business. 10122020 Simon Propertys revenues grew 7 from 54 Bil in 2016 to 58 Bil in 2019.

Simon Property Stock Down 50 Ytd Can It Survive The Covid Storm

Simon Property Stock Down 50 Ytd Can It Survive The Covid Storm

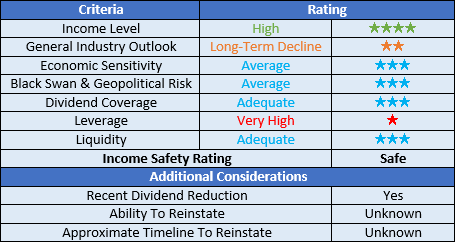

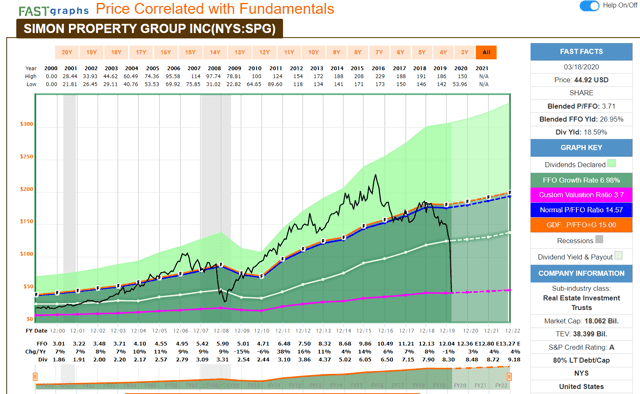

Its net debt to net operating income ratio was 51 as of.

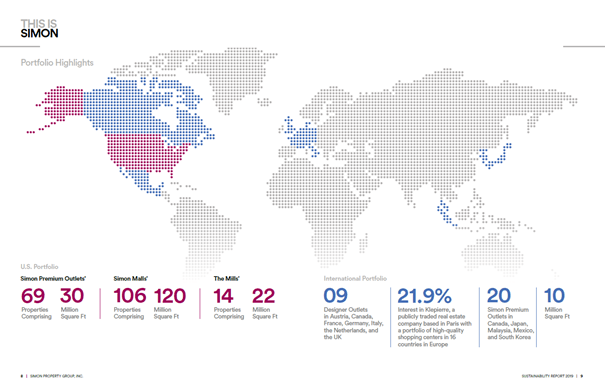

Can simon property group survive. 5192017 Can REITs Like Simon Property Group Survive the Feds Interest Rate Hikes. As such it is well aware of the retail apocalypse. Simon Property Group is a REIT specializing in the ownership development management leasing acquisition and expansion of income-producing retail real estate assets.

The owners of Westfield Garden State Plaza in New Jersey are planning to transform the regions largest shopping center into a downtown with luxury mixed-used residential development where mall lovers can. 272020 Simon Property Group is one of the largest mall landlords in the world. BPY Can Amazon Save the Simon Property Group from Oblivion Could Simon Property Buy JC Jenney How Amazon AMZN makes more money than Target JC Penney OTCMKTS.

JCPNQ Simon Properties Coronavirus Opportunity Simon Property can survive Simon Property Group. Threatening real estate investment trusts REIT and. The company operates five retail real estate platforms.

In addition earnings growth on a per-share basis was higher. The stock has been battered this year. Regional malls premium outlet centers The Mills communitylifestyle centers and international properties.

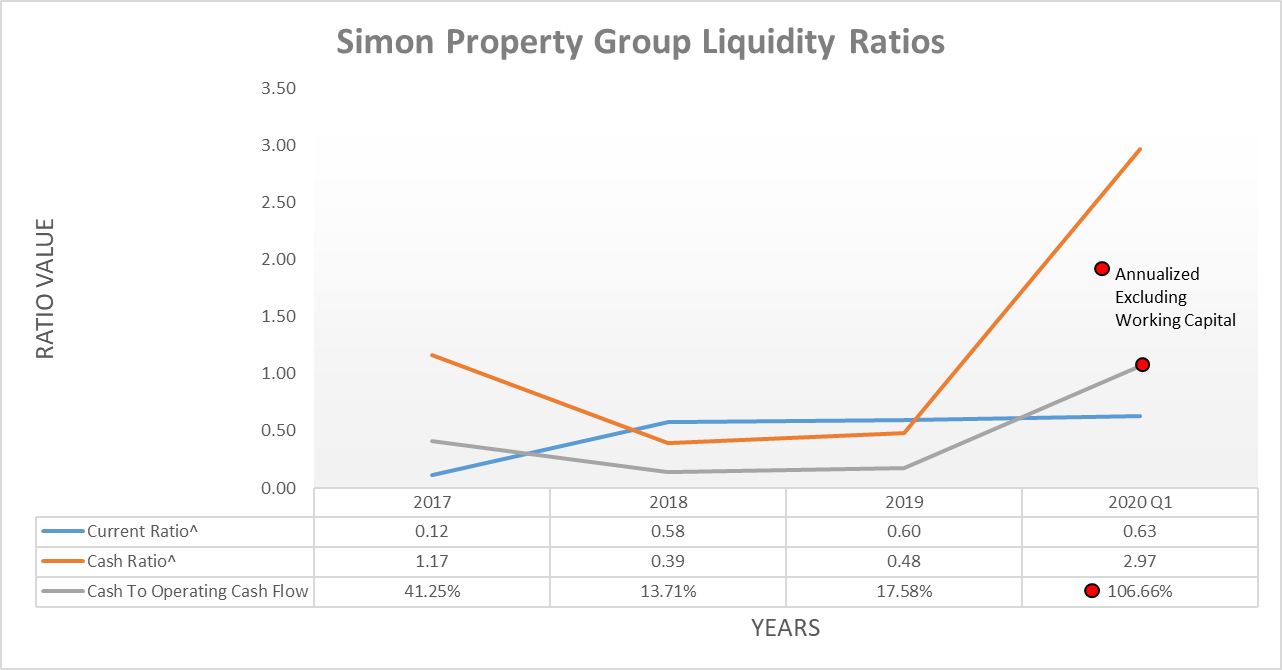

8202020 I think Simon Property Group can survive because it has cash. Is an American commercial real estate company one of the largest retail real estate investment trusts REIT and the largest shopping mall operator in the US. NASDAQAMZN to convert vacant space into distribution centers.

For additional information on REITs visit the National Association of Real Estate Investment Trusts NAREIT. However Simon Property is not naive about the tumults that it will be facing moving forward as it slowly recovers from the nationwide lockdown and some of its clients begin to file for bankruptcy. Yes SPG will survive.

If successful this could unlock an enormous amount of. 1112020 Simon Property Group had 266 billion in debt and 36 billion in cash as of Sept. August 20 2020 August 20 2020 daniel Brookfield Property Partners NASDAQ.

Simon Property Group Inc. Mall owner Simon Property Group could be a buying opportunity in the midst of the coronavirus pandemic. 8252020 Simon Property Group could end up with a smaller more profitable business by closing underperforming stores letting go of some brick and mortar employees and working to fine-tune the brands e.

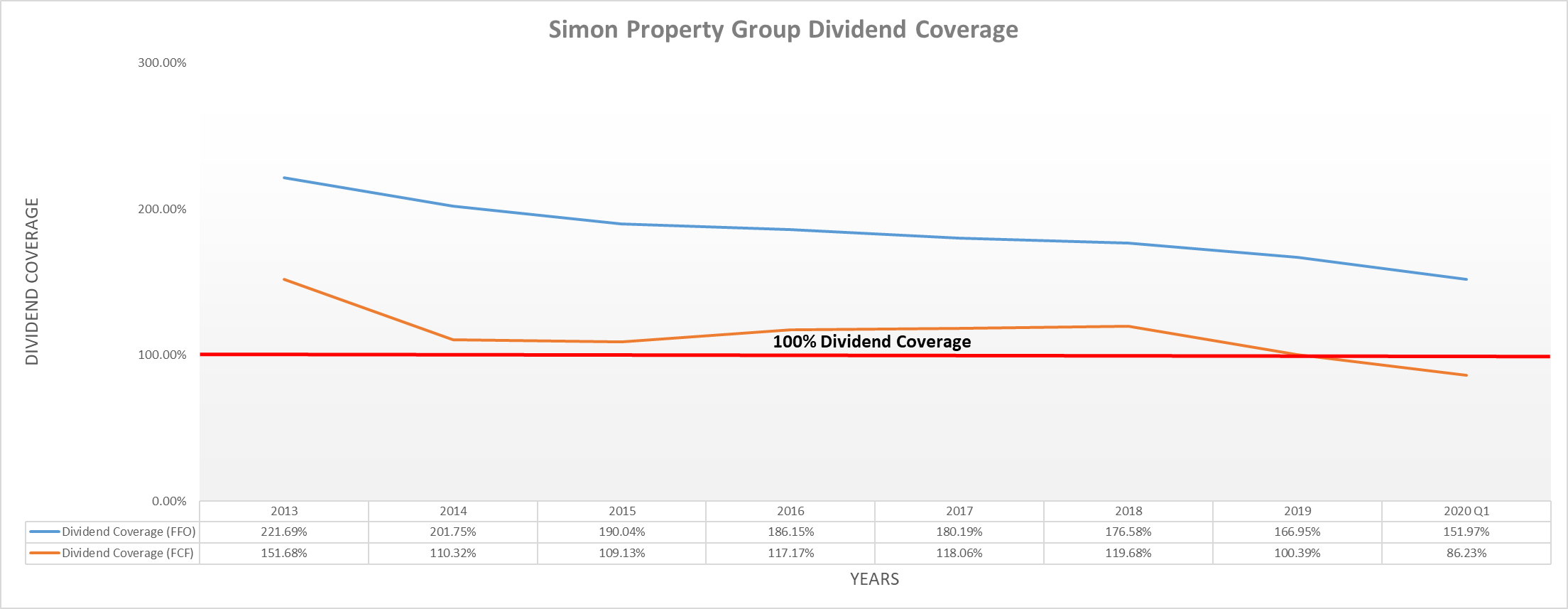

19 2017 Updated 736 am. 5122020 As we have demonstrated Simon Property Group can handle both a realistic and a worst-case downturn. Some analysts think the largest US.

3172021 As the pandemic recedes the question of whether consumers will flock back to their old ways is on the table. 2212020 Simon remains in arguably the best position to survive long term as a premium mall owner but doing so will take constant investment and reinvention. Can Simon Property Survive without Anchor Stores.

Can Amazon Save the Simon Property Group from Oblivion. I am still very bullish over the long term and have a high degree of confidence that SPG will survive. My core investment in the mall space has traditionally been through Simon Property Group.

7292019 Malls that will survive the age of online shopping are the ones that draw people in for reasons beyond simply shopping often by giving them a place to live or work. It may very well even thrive. Even with a potential dividend cut in the worst case the company still has significant growth.

8192020 With the economy poised to further reopen in the coming months Simon Property should see its cash flow return somewhere close to normal. In fact Simon had 3306 billion in cash and short-term investments on 30 June 2020. But the fact that SPG has weathered the bad times of late even just a modest improvement in market conditions should see it profit.

To explain I think Simon could hope to convert malls into distribution centers for e-commerce with Amazons help. That amount fell from 3725 billion on 31 March 2020 and 66937 million on 31 December 2019.

Simon Property Group Spg Reports Q1 2020 Earnings

Simon Property Group Spg Reports Q1 2020 Earnings

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Simon Property Group Spg Reports Q1 2020 Earnings

Simon Property Group Spg Reports Q1 2020 Earnings

Simon Survival Of The Fittest Nyse Spg Seeking Alpha

Simon Survival Of The Fittest Nyse Spg Seeking Alpha

The Retail Apocalypse Is Far From Over And Simon Property Group Is Not Immune Nyse Spg Seeking Alpha

The Retail Apocalypse Is Far From Over And Simon Property Group Is Not Immune Nyse Spg Seeking Alpha

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

Simon Property Group Indianapolis Business Journal

Simon Property Group Indianapolis Business Journal

Simon Property Stock Down 50 Ytd Can It Survive The Covid Storm

Simon Property Stock Down 50 Ytd Can It Survive The Covid Storm

Simon Property Group Asserting Dominance Over Competitors Nyse Spg Seeking Alpha

Simon Property Group Asserting Dominance Over Competitors Nyse Spg Seeking Alpha

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

Simon Property Group And Taubman Centers Merger Is Back On

Simon Property Group And Taubman Centers Merger Is Back On

Simon Property Group Indianapolis Business Journal

Simon Property Group Indianapolis Business Journal

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

Simon Property Group Unlike Other Reits Their 8 Yield Appears Safe Nyse Spg Seeking Alpha

What Does The Future Hold For Malls Look To Simon Property Group

What Does The Future Hold For Malls Look To Simon Property Group

What Happened To The Atrium Mall Atrium Mall Home Furnishing Stores

What Happened To The Atrium Mall Atrium Mall Home Furnishing Stores

Amazon Simon Kick Off Mall Transformation Pymnts Com

Amazon Simon Kick Off Mall Transformation Pymnts Com

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha

Simon Property Group Hunting For Bargains Again Nyse Spg Seeking Alpha